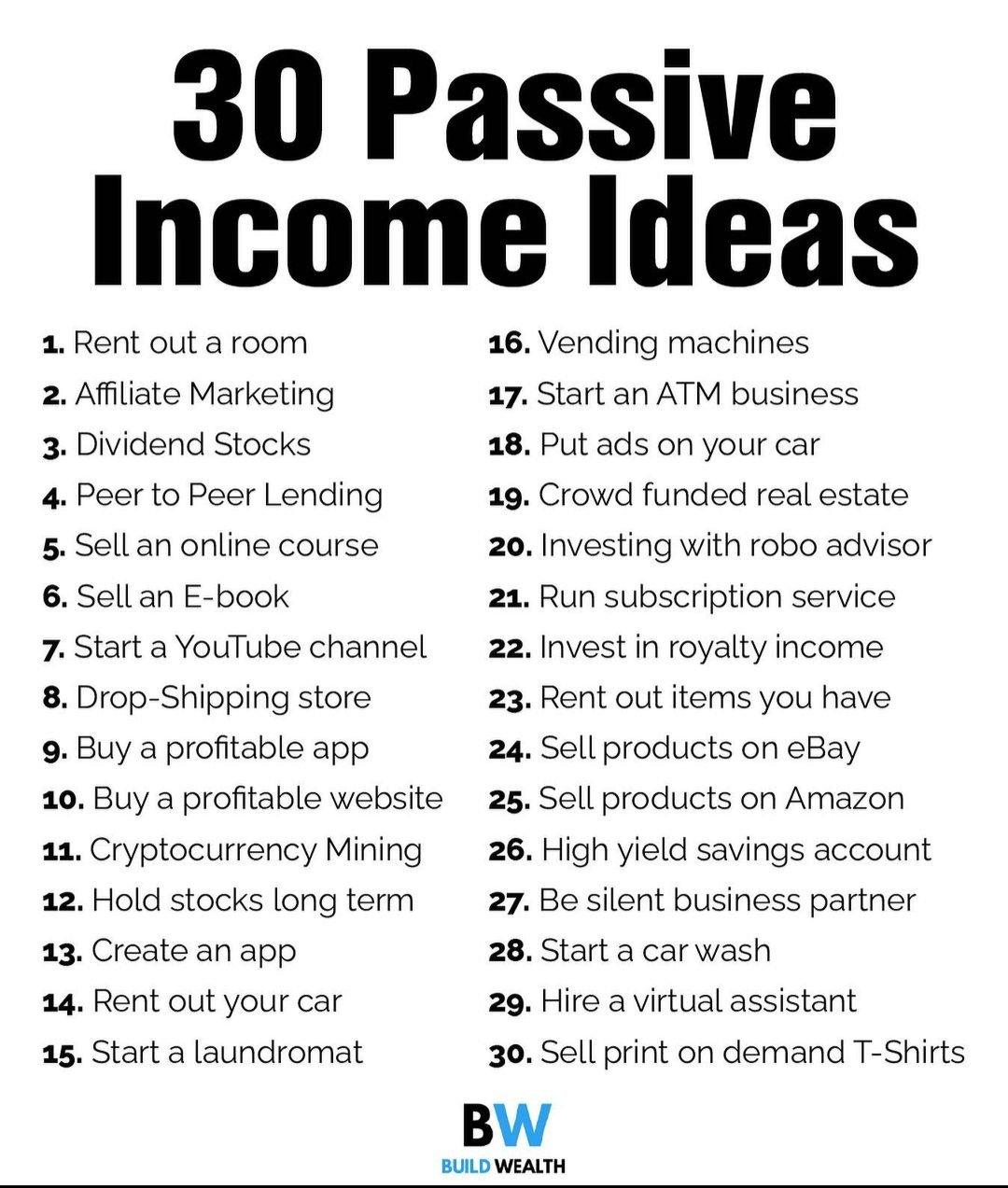

Passive income ideas can help you earn money with little effort. They offer a way to generate cash flow even when you’re not actively working.

Imagine waking up each morning with extra money in your account. That’s the power of passive income. From investments to online ventures, passive income streams can diversify your earnings. This approach offers financial stability and freedom. You can pursue hobbies, travel, or spend more time with family.

Many options exist, suitable for different skills and interests. Whether you’re new to passive income or looking to expand, this guide will explore various ideas. It’s time to discover how to make your money work for you. Dive in and find the best passive income ideas for a brighter financial future.

Credit: medium.com

Introduction To Passive Income

Welcome to our guide on passive income ideas. Passive income can be your ticket to financial freedom. It can help you earn money while you sleep. In this section, we will introduce you to the concept of passive income. We will also discuss its benefits. Read on to learn how passive income can change your life.

What Is Passive Income?

Passive income is money earned with little daily effort. This type of income comes from investments or business ventures. Examples include rental income, dividends, or royalties. Unlike active income, you don’t need to work full-time for it. Once set up, it generates revenue on its own.

Passive income is different from active income. Active income requires your direct involvement. Think of your regular job or freelance work. Passive income, on the other hand, is more hands-off. It lets your money work for you.

Benefits Of Passive Income

Passive income has many benefits. Here are some key advantages:

- Financial Freedom: Passive income can help you achieve financial independence. You won’t rely solely on a 9-to-5 job.

- More Time: With passive income, you have more free time. Spend it with family, friends, or on hobbies.

- Reduced Stress: Financial security reduces stress. You will have peace of mind knowing you have a steady income.

- Diversified Income: Multiple income streams protect you. If one fails, others can support you.

Passive income can also help you grow your wealth. Reinvesting earnings can create a snowball effect. Over time, your income grows larger.

Credit: www.linkedin.com

Real Estate Investments

Real estate investments offer a reliable way to earn passive income. They provide a steady cash flow and potential appreciation over time. With the right approach, real estate can be a lucrative addition to your income streams. Below are two popular methods to generate passive income through real estate.

Rental Properties

Owning rental properties can be a great way to earn passive income. You buy a property, rent it out, and collect monthly rent from tenants. The rental income can cover your mortgage, maintenance costs, and other expenses. Over time, the property may increase in value, providing an additional return on your investment.

Effective property management is key. This includes selecting good tenants, maintaining the property, and handling any issues that arise. You can manage the property yourself or hire a property management company. They will take care of everything, ensuring you a stress-free experience.

Real Estate Crowdfunding

Real estate crowdfunding allows you to invest in property projects with small amounts of money. You join other investors to fund a property purchase or development. This method is less hands-on and offers diversification.

Platforms like Fundrise and RealtyMogul make it easy. You can browse projects, invest, and watch your money grow. You don’t need to worry about property management. The platform handles everything, from tenant management to property maintenance.

Real estate crowdfunding offers flexibility. You can choose the projects that match your investment goals. It’s a good option for those who want to invest in real estate without owning property directly.

Stock Market Investments

Investing in the stock market is a popular way to generate passive income. It offers various opportunities to earn money without actively working for it. Let’s explore some of the most effective stock market investments.

Dividend Stocks

Dividend stocks are shares of companies that pay regular dividends. Dividends are a portion of a company’s earnings distributed to shareholders. These payments can provide a steady stream of income.

Investors prefer dividend stocks because they offer consistent returns. Many well-established companies, like those in the S&P 500, pay dividends. Here are some key benefits:

- Reliable income

- Capital appreciation

- Reinvestment options

To invest in dividend stocks, research companies with a history of paying dividends. Look for strong financials and a stable dividend payout ratio.

Index Funds And Etfs

Index funds and ETFs (Exchange-Traded Funds) are another passive income option. They track the performance of a specific market index, such as the S&P 500.

These investments offer diversification. They spread your money across many different stocks. Here are some key benefits:

- Low fees

- Broad market exposure

- Reduced risk

Here is a comparison table for Index Funds and ETFs:

| Feature | Index Funds | ETFs |

|---|---|---|

| Trading | End of day | Throughout the day |

| Fees | Generally higher | Generally lower |

| Minimum Investment | Higher | Lower |

To invest in these, choose a reputable brokerage platform. Look for low expense ratios and a good track record.

Digital Products

In today’s digital age, passive income can come from various sources. One of the most effective ways is through digital products. Digital products are assets or media that can be sold online. These products often require an initial investment of time and effort. But once created, they can generate income with minimal ongoing work.

E-books And Online Courses

Creating e-books is a popular way to earn passive income. E-books require you to write content once. Then, you can sell them repeatedly. Platforms like Amazon Kindle Direct Publishing make it easy to publish and sell your e-books. Choose topics you are passionate about. This will make the writing process easier.

Online courses are another excellent digital product. They can provide substantial income. Create courses on subjects you know well. Websites like Udemy and Teachable allow you to host and sell your courses. Students pay for access. They can learn at their own pace. This setup benefits both you and your students.

Software And Apps

Developing software or apps can be a lucrative passive income source. If you have programming skills, this can be a great option. Create a useful app or software that solves a problem. Once developed, you can sell it on platforms like Google Play or the Apple App Store. Each download or purchase generates income.

Even if you are not a programmer, you can still get involved. Hire a developer to bring your app idea to life. Market your app effectively. This will increase downloads and sales.

| Digital Product | Platform | Revenue Model |

|---|---|---|

| E-books | Amazon Kindle | One-time Purchase |

| Online Courses | Udemy, Teachable | One-time Purchase, Subscription |

| Software and Apps | Google Play, Apple App Store | One-time Purchase, In-app Purchases |

Peer-to-peer Lending

Peer-to-peer (P2P) lending connects borrowers and lenders directly. This method eliminates banks and other financial institutions. Instead, it uses online platforms to facilitate these transactions. P2P lending can offer higher returns compared to traditional investments. It also provides an opportunity to diversify your income sources.

How Peer-to-peer Lending Works

P2P lending platforms act as intermediaries. They connect individuals who need loans with those willing to fund them. Here is a simple process:

- Borrowers create loan listings with details such as amount and purpose.

- Lenders review these listings and choose where to invest.

- Once funded, borrowers repay the loan with interest over time.

These platforms often assess the credit risk of borrowers. They use various criteria, like credit scores and income. This helps lenders make informed decisions. The loans are usually divided into smaller portions. This allows multiple lenders to fund a single loan, spreading the risk.

Top Platforms For Peer-to-peer Lending

Several platforms dominate the P2P lending market. Here are some of the top ones:

| Platform | Key Features |

|---|---|

| LendingClub | Offers personal loans and small business loans. Easy to use interface. |

| Prosper | Focuses on personal loans. Provides detailed borrower profiles. |

| Funding Circle | Specializes in small business loans. Offers comprehensive risk assessment. |

| Upstart | Uses AI to assess borrower risk. Offers competitive returns. |

Each platform has unique features. It is important to research and choose one that aligns with your investment goals. Diversifying across multiple platforms can also help manage risk.

Affiliate Marketing

Affiliate marketing offers a great way to earn passive income. You promote products or services. When someone buys through your link, you earn a commission. It’s simple. The key is choosing the right products and building trust with your audience.

Choosing The Right Niche

Start by picking a niche you know well. Passion matters. If you love what you’re promoting, it shows. Focus on a niche with demand. Research trends and popular products. Look for gaps in the market. Fill those gaps with valuable content. This helps you stand out.

Building An Audience

Content is king. Create helpful and engaging content. Blogs, videos, and social media posts work well. Share your knowledge and experiences. Be consistent. Post regularly. Interact with your audience. Answer questions and respond to comments. Building trust takes time.

Email marketing is powerful. Build an email list. Offer a freebie or discount for sign-ups. Send regular newsletters with valuable tips and offers. Personalize your emails. Make your audience feel special.

Use SEO strategies. Research keywords related to your niche. Use these keywords in your content. This helps you rank higher on search engines. More traffic means more potential commissions.

Create An Online Business

Creating an online business can be a great way to earn passive income. The internet offers many opportunities to start a business with low investment. It allows you to reach a global audience. You can choose from various models based on your interests and skills. Here, we will explore two popular options: E-commerce stores and Dropshipping.

E-commerce Stores

E-commerce stores are online platforms where you can sell physical or digital products. You can start by setting up a website using platforms like LaunchMyStore or WooCommerce. These tools offer templates and easy-to-use features. You don’t need to be a tech expert to get started.

Focus on a niche market to attract a specific audience. For example, you can sell handmade crafts, vintage clothing, or digital downloads. Good product photos and descriptions are essential. They help to draw in customers and make sales. Invest time in SEO to rank higher on search engines. This will drive more traffic to your site.

Social media can also boost your e-commerce business. Share posts about new products and special offers. Engage with your customers through comments and messages. Building a loyal community can increase your sales over time.

Dropshipping

Dropshipping is another way to create an online business. It allows you to sell products without holding inventory. You partner with a supplier who handles storage and shipping. When a customer makes a purchase, the supplier ships the product directly to them.

This model has low startup costs and is easy to manage. You can focus on marketing and customer service. Choose a reliable supplier to ensure product quality and timely delivery. Use platforms like Oberlo or Spocket to find suppliers and integrate them with your online store.

Like e-commerce, targeting a niche can help you stand out. Conduct market research to find products in demand. Use SEO strategies to improve your store’s visibility. Regularly update your website with new products and promotions. This keeps your store fresh and engaging for returning customers.

Credit: www.pinterest.com

Automated Savings And Investments

Investing in automated savings and investments can be a smart way to build passive income. These methods require minimal effort once set up. Let your money work for you. Explore different options to find what suits your needs best.

Robo-advisors

Robo-advisors are online platforms that provide financial advice. They manage your investments with little human intervention. They use algorithms to build and manage your portfolio. This makes investing easier and more accessible. Typically, robo-advisors have lower fees than traditional financial advisors.

Here are some benefits of using robo-advisors:

- Low fees

- Automated rebalancing

- Tax-loss harvesting

- Low minimum investments

Popular robo-advisors include Betterment, Wealthfront, and M1 Finance. Choose a platform that aligns with your financial goals.

High-yield Savings Accounts

High-yield savings accounts offer higher interest rates than regular savings accounts. They are a safe place to store your money while earning interest. These accounts are typically offered by online banks. They often have fewer fees and better rates than traditional banks.

Consider these factors when choosing a high-yield savings account:

- Interest rate

- Fees

- Minimum balance requirements

- Accessibility

Some well-known options include Marcus by Goldman Sachs, Ally Bank, and Synchrony Bank. Compare different accounts to find the best fit for your needs.

Automated savings and investments can simplify your financial life. These methods help you grow your money with minimal effort. Start with small steps and watch your passive income grow.

Conclusion And Next Steps

As we wrap up our exploration of passive income ideas, it’s essential to focus on what comes next. Knowing where to start and what steps to take can make a significant difference in your journey towards financial freedom.

Setting Goals

Begin by setting clear, achievable goals. Decide how much passive income you want to earn. Break down your goals into smaller, manageable tasks. This will help you stay motivated and on track.

Taking Action

After setting your goals, the next step is to take action. Research your chosen passive income ideas thoroughly. Gather as much information as possible. This will help you make informed decisions.

Start small and scale up as you gain confidence and experience. Consistent effort will yield results over time. Remember, the key is to stay persistent and patient.

Frequently Asked Questions

What Are Passive Income Ideas?

Passive income ideas are ways to earn money without active involvement. Examples include renting property, dividends, and royalties.

How Can I Earn Passive Income?

You can earn passive income through investments, real estate, creating digital products, or affiliate marketing.

Is Passive Income Really Passive?

No, passive income often requires initial effort and maintenance. But it can generate earnings with less ongoing work.

What Are The Best Passive Income Sources?

The best sources include rental properties, dividend stocks, peer-to-peer lending, and creating online courses.

Can Passive Income Replace A Full-time Job?

Yes, but it takes time and effort. Diversify income streams and be patient for sustainable earnings.

How Much Money Do I Need To Start?

It varies by method. Some, like creating a blog, need little money. Others, like real estate, need more investment.

Conclusion

Earning passive income can be life-changing. Start small and stay consistent. Explore various options to find what suits you best. Remember, patience and effort are key. Over time, your passive income streams will grow. Enjoy the benefits of extra cash flow.

Invest wisely, and keep learning. The right passive income idea can bring financial freedom. Stay committed and watch your efforts pay off. Happy earning!